Sumba Real Estate 2025: Land, Villas & Eco-Resort Investment Guide

- November 21, 2025

- 3 minutes

If you’re typing “Sumba real estate” or “real estate Sumba” into Google, you’re probably asking yourself a simple question:

Is Sumba a serious place to invest in property, or just a beautiful idea?

This guide is written to help you answer that question with realistic, investor-grade information, not hype.

We’ll walk through:

- How the Sumba real estate market actually looks in 2025

- The main property types: raw land, standalone villas, managed resort/villa projects

- The legal and ownership routes for foreigners (and their real pros/cons)

- The most relevant locations and what kind of buyer they suit

- Who Sumba is and isn’t a good fit for

- Where a small, managed resort like Kabisu sits in this landscape

Where useful, we’ll point you toward deeper articles on our blog (e.g. legal details, island comparisons) so we don’t duplicate content you may already have read.

1. The Sumba Real Estate Market in 2025: Early, Real, and Moving Fast

From “next Bali” cliché to a real investment story

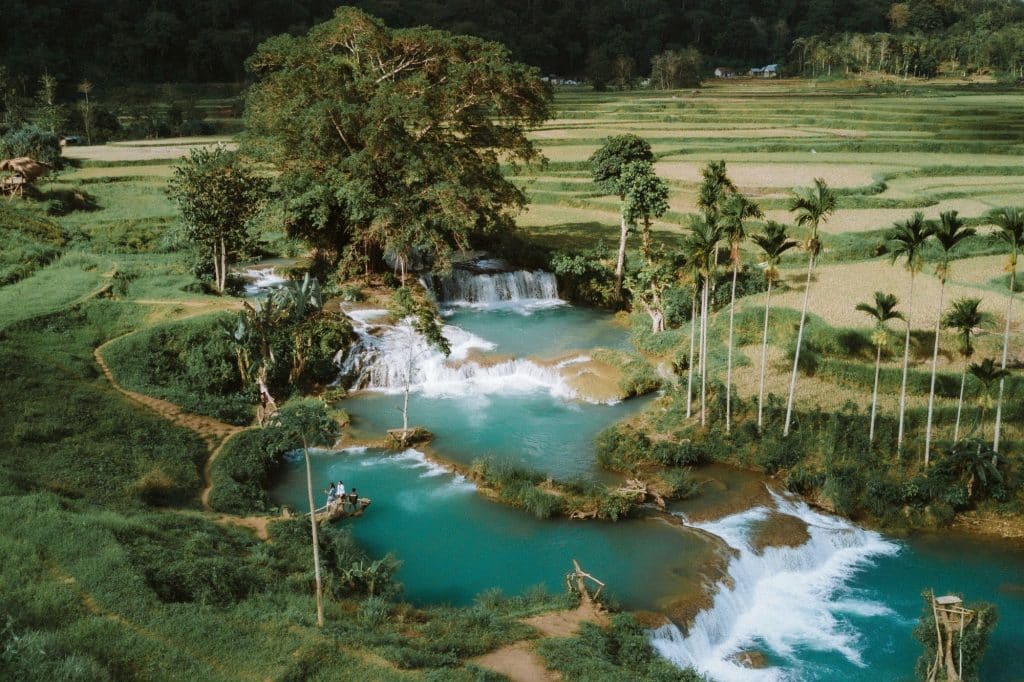

Over roughly the last decade, Sumba has moved from being “that wild island with horses and Pasola” to a recognised investment destination.

A few key facts:

- Specialist brokers and developers report significant land price growth in the most strategic parts of Sumba,

in some cases multiples of original prices since the early 2010s, while still well below equivalent Bali

beachfront. - Tourism is growing from a low base: more boutique resorts, surf lodges and eco-projects in West and South

Sumba, underpinned by upgraded airports and better road access. - Policy and private capital are broadly aligned around

low-density, higher-value tourism rather than mass, high-rise development.

For property buyers, this means Sumba now sits in an interesting place:

- Less speculative and more visible than even five years ago

- But still much earlier-stage and lower-density than Bali or even Lombok

In other words, the market is real, but it hasn’t yet been flooded by large-scale, cookie-cutter development.

2. What People Actually Mean by “Sumba Real Estate”

If you scan today’s first-page Google results and brokerage sites, “Sumba real estate” usually means one of

three things:

- Raw land: often big plots of cliff, beachfront or hillside land marketed by specialist agencies and investment groups, sometimes with dramatic growth charts.

- Individual villas: a handful listed on bigger Indonesia property portals, often near existing resorts or surf spots.

- Resort / villa projects: eco-resorts or boutique developments selling units with projected yields and capital appreciation.

So when someone says “I want to invest in Sumba real estate”, they might be thinking of:

- Buying land and holding or developing it

- Buying a standalone villa to use and rent

- Buying into a managed resort-style project with professional operations

Each route involves completely different risk, workload and return profiles. That’s what we’ll unpack next.

For broader macro context (tourism, roads, airports, timelines), you can refer to a detailed “Sumba Investment

Outlook 2030” style article if you want to go deeper on the big picture.

3. Types of Sumba Real Estate: Land, Villas & Managed Resorts

3.1 Raw land: high upside, high responsibility

Who it’s for:

Investors comfortable with frontier markets, long time horizons and heavy due diligence.

Common plays:

- Beachfront / cliff land in West and Southwest Sumba, near known surf breaks or existing resorts

- Larger inland parcels suited for eco-retreats, regenerative agriculture or future hospitality

- Early tourism corridors along newly improved coastal or connecting roads

Pros

- Lowest entry price per square metre compared to finished villas

- Greatest potential capital gains if you pick the right location and hold through

infrastructure and tourism growth - Flexibility: you can partner with a developer later, or exit once the area is better known

Cons

- You carry the whole burden of due diligence:

- Land certificates, overlaps, adat/customary rights

- Road access, utilities, zoning / spatial planning

- You need a clean structure as a foreigner (typically via PT PMA or a well-drafted lease),

plus reliable local legal support - Land can sit idle for years before the surroundings mature enough to sell or build

Raw land is a development or long-hold play, not a quick “buy and flip” instrument.

3.2 Standalone villas: lifestyle plus work

Who it’s for:

People who want a tangible holiday home and are ready to handle (or pay for) operations.

You’ll find standalone villas:

- On private plots near known bays, surf spots or viewpoints

- In small clusters near existing resorts

- Sometimes as one-off builds by early adopters

Pros

- You own a finished asset you can use, furnish and personalise

- Easier to visualise and finance than raw land

- In the right micro-location, nightly rates can be strong as Sumba’s brand grows

Cons

You’re effectively running a tiny hotel:

- Operations: staff, maintenance, security, utilities, owner stays

- Distribution: marketing, OTAs, direct bookings, brand

- Consistency: keeping standards high in a remote location

If you live abroad, you depend heavily on local managers. Without a solid relationship and systems, returns and guest experience can suffer.

Standalone villas suit investors who either plan to be physically present quite often, or who enjoy building and managing their own micro-brand.

3.3 Managed resort & villa projects: exposure without becoming a hotelier

The third option is entering Sumba real estate through a professionally managed resort or villa collection.

This can look like:

- A boutique resort where you own one or several units

- A villa estate fully managed by an operator

- Hybrid models with rental pools and shared facilities (restaurant, bar, pools, wellness, etc.)

Pros

- Hands-off operations: staffing, training, maintenance, guest experience managed by a dedicated team

- Brand & distribution: you benefit from the resort’s marketing, partnerships and repeat guests

- Shared risk via rental pool: your income is tied to the performance of the whole resort, not just your individual booking hustle

- Often designed from day one with sustainability and community integration built-in

Cons

- You buy into a system: design and operations are not 100% customisable

- You must be comfortable with how fees, transparency and reporting are structured between owners and the operator

- Returns depend heavily on the competence and alignment of the team running the property

For many long-distance investors, this is the most realistic way to get Sumba exposure without trying to run a mini-hotel from abroad.

Kabisu sits in this category, more on that shortly.

4. Legal Routes for Foreigners in Sumba Real Estate

Indonesian property law looks complex at first, but on Sumba the foreign-investor story boils down to three main tools:

- Leasehold (Hak Sewa): essentially buying time and usage

- PT PMA (foreign-owned company): the most robust, business-grade solution

- Nominee structures: still used informally, but legally fragile

Important: This is an overview, not legal advice. Regulations evolve, and hospitality has its own sector rules. Always confirm specifics with a local notary (PPAT) and independent legal counsel.

4.1 Leasehold (“Hak Sewa”): useful, but structurally limited

Leasehold is often presented as the “simple” foreigner solution: a 25–30-year lease over land or a villa, sometimes with options to extend. It can work, but it’s important not to oversell what it is.

How it works

- You sign a notarial lease agreement with the landowner (and/or building owner).

- You pay an upfront lease fee, sometimes in stages.

- The contract may include extension options, but these are contractual clauses, not guaranteed rights.

Where leasehold can make sense

- You primarily want usage and rental cash-flow over a defined period.

- Your total budget is too small to justify a PT PMA structure.

- You’re realistic that this is more of a short term play than a multi-generation asset.

Key limitations (often glossed over in sales pitches)

- No land equity, limited capital appreciation

You never own the underlying land; you own time-bound usage rights.

In a hot market, leasehold villas can see price increases early in the lease term. But structurally, as each year passes, the remaining lease shortens and the rights move towards zero at expiry.

For long-term wealth building and true capital appreciation, it’s weaker than holding land or HGB via a PT PMA. - Renewal is uncertain and can be expensive

Unless the extension mechanism is very clearly defined and priced in the original contract,

renewal is not guaranteed.

By the time you want to extend, you may already have a villa and business on the land. That can put the landowner in a strong negotiation position. - Licences & rentals are less clean than with a PT PMA

To legally run short-term rentals (daily/weekly) in Indonesia, you generally need a hospitality licence (e.g. Pondok Wisata / hotel-type licence) and a business entity.

For foreigners, the clean way is to use a PT PMA that holds the permits; a personal lease alone is not enough.

Many owners run leasehold villas in a grey zone or rely on a local person’s licence. That might “work” day-to-day but does not offer the same legal comfort as a properly licensed PT PMA. - Less suited for serious, scalable investment

Leasehold is acceptable for one villa, one family, one time horizon.

For anything that looks like a business, multiple units, staffed operations, a brand, the combination of no land equity, renewal risk, and licensing complexity makes PT PMA a much more robust base.

In short: leasehold can be useful if you’re clear you’re buying usage and income over time. For serious, long-term Sumba real estate investment, it’s best seen as a secondary tool compared to PT PMA-based structures.

4.2 PT PMA (foreign-owned company): safest, but with high capital requirements

For larger or more serious investments, most professional foreign investors use a PT PMA, an Indonesian limited company with foreign shareholding.

Common use cases

- Developing a resort or villa project

- Holding multiple plots or a portfolio of units

- Running an on-island hospitality business with staff, vehicles, boats, etc.

Typically:

- The PT PMA holds buildable land rights (Hak Guna Bangunan / HGB) or other suitable titles.

- It enters into construction contracts, employment agreements, and distribution agreements.

- It can legally hold the operating licences for accommodation and F&B.

Why PT PMA is considered the safest / most robust route

A properly structured PT PMA is generally the gold standard for foreign investment because:

- It’s an on-shore structure explicitly recognised by Indonesian investment law.

- Ownership and control are clear: you own shares in the company that owns/leases the property and runs the business.

- It’s easier to prove your rights, bring in partners or financing, and exit later via a share sale.

- Regulators expect serious tourism and real estate projects to use PT PMA, not “creative” short-cuts.

This is why most resorts and professionally structured projects in Indonesia, including in Sumba, sit on top of PT PMA structures.

The catch: minimum capital and project size

The downside is that PT PMA is not designed for small, casual purchases.

Under current rules and practice A PT PMA typically needs to present a minimum total investment plan above IDR 10 billion.

In practice, this means:

- Setting up your own PT PMA just to own one small villa makes little sense.

- PT PMA is suited to resort-scale projects, portfolios of villas/units, investment groups pooling capital, or individual investors joining an existing PT PMA structure that already meets the thresholds.

So PT PMA is both the safest, most complete route, and a big tool, designed for true business-scale investment, not a 50–100k EUR experiment.

4.3 Nominee structures: still common, but risky

In some parts of Indonesia, foreigners are offered informal “nominee” arrangements:

- An Indonesian citizen holds a freehold title in their name.

- Side contracts attempt to give the foreigner economic rights.

From a risk standpoint:

- You depend entirely on trust and private contracts with one person.

- Disputes and enforcement can be messy and uncertain.

- Authorities have repeatedly signalled that structures designed to circumvent property rules are not encouraged.

Most serious investors in Sumba now avoid nominee setups and focus on:

- Clean, documented leasehold where appropriate

- PT PMA for larger projects

- Joining properly structured PT PMA-based resorts rather than ad-hoc workarounds

5. Where to Buy: Key Sumba Real Estate Areas

Sumba is big, and each region has a different risk/return profile. For most real estate investors, three zones matter.

5.1 West Sumba: current epicentre

West Sumba is where you’ll find:

- Tambolaka Airport (TMC), with regular flights from Bali and other hubs

- Established and emerging luxury resorts and boutique projects along the west and southwest coasts

- A growing cluster of cliff and beachfront land listings targeting foreign buyers

Why it matters:

- Access: airports and paved roads are critical for operations and guest comfort

- Social proof: existing high-end resorts validate the destination

- Logistics: easier to source materials, services and staff

For managed resort or villa projects, this is currently the most coherent area.

5.2 South and southwest coasts: wild, spectacular, earlier

The southern coastline is dramatic: long empty beaches, headlands, river estuaries and surf.

Typical characteristics:

- Exceptional natural beauty, often with little around

- Road access that ranges from good in some sections to rough in others, though improving over time

- Attractive for eco-projects, surf retreats and land banking

These areas can offer compelling land prices and upside, but demand:

- Longer time horizons

- Comfort with infrastructure risk

- Solid, locally rooted partners to navigate land and community matters

5.3 East Sumba & Waingapu: earlier, more spread out

East Sumba, around Waingapu, has:

- Its own airport

- Distinctive savannah landscapes and some early-stage hospitality projects

From a real estate perspective:

- The luxury/hospitality cluster is less concentrated than in West Sumba

- Tourism is earlier in its curve

- The region suits patient land investors and carefully planned niche projects

6. Is Sumba Real Estate a Good Fit for You?

Sumba is not the right island for everyone. That’s part of its appeal.

6.1 Sumba might be right for you if…

- You think in years and decades, not quarters. A 5–7+ year horizon feels normal, not scary.

- You care about scarcity and low density more than shopping and nightlife.

- You want your capital to help shape sustainable, small-scale development, not add to overbuilding.

- You’re okay with some operational complexity in return for getting in early.

6.2 Sumba might not be right for you if…

- You want high liquidity and quick exit options like a listed REIT.

- Your profile fits best with a mature market and thick transaction volumes.

- You’re looking for “plug-and-play” ownership where the legal and infrastructure frameworks are identical to Bali.

If you’re still comparing islands, you can deepen your thinking with detailed “Sumba vs Bali” and “Sumba vs Lombok” type comparisons.

7. How Kabisu Fits into the Sumba Real Estate Landscape

Most “Sumba real estate” pages you’ll find online are run by generalist brokers or land aggregators. Kabisu is intentionally different.

7.1 A small, focused resort: not a scattered portfolio

Kabisu is a limited villa collection in West Sumba built as a cohesive resort:

- A small number of cliff front and ocean-view villas within one masterplan

- Shared facilities: restaurant, bar, pools, concierge, experiences

- A long-term operating team with experience building and running projects in remote Indonesian locations

Instead of trying to list dozens of unrelated properties, Kabisu offers:

- 10 villas only, all part of the same design language and operating model

- Fully managed units plugged into a shared rental pool, so income is based on the performance

of the whole resort rather than just your own booking hustle

7.2 PT PMA structure without each investor needing 10+ billion IDR

Behind the scenes, Kabisu uses a proper PT PMA structure at the project level:

- The company, not an informal nominee, holds the relevant land and operating licences

- The project meets the minimum capital and investment thresholds expected of serious foreign investment

- Individual investors don’t each need to set up their own PT PMA and inject IDR 10+ billion; they participate through a structure that already complies at that scale

From an investor’s perspective, that means:

- You get exposure to Sumba real estate and its long-term upside

- Your returns are linked to a professionally run hospitality business

- The legal and operating framework is cleaner and more robust than ad-hoc leasehold or nominee solutions

If you want to understand the operating philosophy in more detail, you can look for content that explains Kabisu’s approach beyond renders and spreadsheets, and how its villa shared pool model is structured.

For detailed pricing, ownership options and projected returns, visit our investment page.

8. Practical Next Steps if You’re Exploring Sumba Real Estate

If you’re still at the research stage, a simple approach is:

- Clarify your role

Do you want to be a developer (land + projects)? A hands-on villa owner? Or a passive investor in a managed resort? - Read deeper by theme

Look for:- Macro trends & timing – long-term Sumba investment outlooks.

- Legal routes & structures – detailed guides to investing in Sumba.

- Island comparisons – Sumba vs Bali, Sumba vs Lombok, etc.

- Ownership and revenue models – explanations of rental pools, shared ownership, and management structures.

- Visit the island

No article can replace walking the land, meeting people and experiencing the distance from mass-market tourism. - Speak with projects or advisors that match your profile

Use the first conversation to talk honestly about:- Time horizon

- Risk tolerance

- Desired involvement (hands-on vs hands-off)

- What “success” looks like for you in 10 years’ time

9. Sumba Real Estate: Quick FAQ

Can foreigners buy real estate in Sumba?

Yes, but not by simply putting a freehold land title in a foreigner’s personal name.

In practice, foreigners use:

- Long-term leaseholds, properly drafted and registered (good for defined-horizon, cash-flow-focused plays)

- PT PMA structures for larger, business-scale investments, where the company can hold buildable land rights and licences (typically with a minimum investment plan above IDR 10 billion

- Participation in structured resort/villa projects that already sit inside a compliant PT PMA

Informal nominee arrangements exist but carry significant legal and practical risk and are increasingly

discouraged.

How much does land cost in Sumba?

Prices vary enormously by:

- Region (West vs East)

- Distance to airport and main roads

- Proximity to existing resorts or attractions

- Views (cliff, absolute beachfront, near-beach, inland)

Current public listings show, for example:

- Cliff / beachfront plots in West Sumba marketed around IDR 24 million per are (100 m²) in some cases, and higher in prime micro-locations.

- More remote or inland parcels at lower prices, but with higher infrastructure risk.

Treat online asking prices as indications, not final truths, serious decisions require local valuation and negotiation.

Do leasehold villas in Sumba appreciate in value?

Leasehold rights are time-bound, so their value naturally tends to decline as the expiry date approaches.

In a fast-rising market, early leasehold prices can go up for a while, especially if the property is in a very strong micro-location and demand outpaces supply. But structurally:

- You don’t own land equity

- You’re “using up” the lease duration each year

- Any capital appreciation is constrained compared to freehold/HGB held via a PT PMA

We see leasehold primarily as a cash-flow and usage instrument, not a pure capital-growth play.

Is Sumba more a lifestyle or financial investment?

It can be both, but Sumba rewards investors who treat it as a long-term, values-aligned financial decision:

- A way to align your capital with low-density, nature-driven development

- An asset you can actually stay in and experience

- A potential source of attractive returns if you choose the right structure and partner

If you’re chasing the highest short-term yield with maximum liquidity, there are easier markets.

If you care about what you’re building and where, Sumba deserves a serious look.

Discover More About Sumba